How to Find the Best Fixxer Upper House

While the process of buying and renovating logroller-upper homes has increased in popularity due to set up-and-flip home improvement TV shows, not everyone is cut out for major renovation projects.

In fact, only 19% of homeowners said their home needed serious updates, and just three% said their home needed a complete overhaul, according to the Zillow Group Consumer Housing Trends Report 2020.

Buying a logroller-upper involves purchasing the least desirable dwelling house on the block and overseeing its transformation. Whether yous're because a logroller as an investment — and y'all plan to sell after construction is consummate — or you're fixing up a domicile to make it your ain, in that location's a lot to consider when buying a logroller-upper, from abode toll to construction costs to financing.

What is a logroller-upper abode?

A fixer-upper is a abode that needs repairs, but not so many that it'due south uninhabitable or worthy of beingness torn down.

Fixer-uppers are commonly offered for a lower toll than homes in amend condition, which makes them appealing to buyers looking to maximize their purchasing power or investors looking to flip the property and turn a profit.

Should I buy a fixer-upper home?

Virtually often, people buy logroller-upper homes because the cost of purchasing the abode plus renovation costs may total less than what they'd pay for a comparable habitation in good condition.

Here are some of the central reasons buyers decide on buying a logroller-upper:

Reduced price

If you take your eye on a popular neighborhood, either for resale value or your ain lifestyle, you may exist able to get a better bargain ownership a fixer upper in your desired location and renovating information technology than purchasing an already-updated abode.

Customizable improvements

When you purchase a logroller-upper, the heaven'due south the limit when it comes to fixtures and finishes (inside your budget, of class). Renovating a fixer-upper can be platonic for buyers with very specific tastes or those who want more than command over the aesthetics of their home. When buying a fixer-upper, you avoid paying for the renovations someone else completed, particularly if you don't similar them.

Older dwelling charm

The character of older homes isn't easy to replicate. Ownership an older home in need of some TLC can allow yous to restore and maintain time period details, while bringing the home up to today's efficiency, safety and condolement standards.

Brand a turn a profit

Whether you're planning to flip or live in the home for a few years earlier selling, you may be able to turn a good profit based on the renovations yous make. Your render on investment depends on the types of renovations you consummate, the materials yous apply and the quality of the piece of work. If profit is the goal, select pop dwelling improvements in your market place to increment property value and appeal to a wide variety of buyers.

Taxation incentives

In some metropolitan areas, such equally Philadelphia and Cincinnati, buyers who buy a fixer-upper and renovate to meliorate the belongings value may be eligible for a tax abatement or credit.

How to observe fixer-upper homes

Finding the right fixer-upper is all most where yous look. Here are a few strategies for finding the correct domicile.

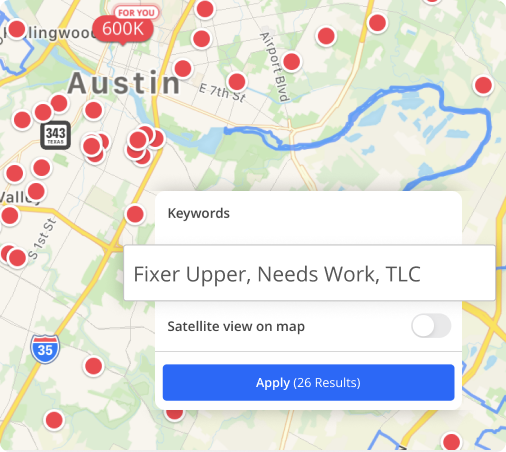

Desire to find logroller upper homes in your area? Narrow downwardly your search using the Keyword section of the Zillow app.

Search online: Use Zillow to search for homes beneath market value. You can search keywords such equally "fixer upper," "needs piece of work" or "TLC" to narrow downwards potential backdrop.

Work with an agent: A local buyer's agent should be able to help you lot find fixer-upper homes in your desirable neighborhoods. Well-connected agents may fifty-fifty be able to show yous homes that haven't hit the marketplace all the same, via word of mouth.

Search auctions, foreclosures and short sales: Distressed properties may be in fine structural condition but are sold below market value in gild to offload them quickly. Information technology'south important to annotation that these homes are normally sold as-is, and disclosures might not be available, so be certain you accept enough extra coin in your upkeep to cover surprise issues.

What to await for when buying a fixer-upper dwelling

When shopping for a fixer-upper, prioritize the things you can't change most a dwelling house (similar its location), or things that would be too costly to change (like significant structural renovations). Hither are cardinal factors to consider:

Location

Location is the most important thing to look for, considering it can't be changed. Look for a fixer-upper in a desirable or an up-and-coming neighborhood in order to maximize potential resale value . Finding the correct location will too ensure that yous're happy in the home. Pay attention to things that might be important to y'all, like school ratings, nearby parks and restaurants and commute times.

The abode's location will also play a part in determining your renovation budget and estimating the home's postal service-renovation value. The quality of finishes and upgrades you lot select should be in line with comparable homes in the same neighborhood if your goal is to recoup costs on resale.

Layout and size

With a fixer-upper, you might be able to alter the layout as you see fit, but pay attention to any design and layout ideas that would require removing load-bearing walls. This can be a plush practise, and sometimes it's simply not possible. Home additions to increase square footage are too expensive and might not be allowed, depending on local zoning requirements and laws.

Home condition

There's a difference between a fixer-upper and a dwelling with significant structural defects. Structural and mechanical problems are a lot more expensive to gear up than cosmetic ones. Be sure to hire a habitation inspector to gain noesis of the home's positives and negatives — hiring a dwelling inspector is an invaluable step, even if you're buying a dwelling house as-is. Here'southward what should exist on your home inspection checklist for a fixer-upper:

- Potent foundation

- Upward-to-lawmaking electrical

- Proper plumbing

- Solid roof status (should come with roof certification)

- HVAC and/or key AC

- Functional windows

Straightforward cosmetic updates

Prioritize homes that have outdated or worn out finishes that don't entreatment to the general public but can exist updated affordably and without likewise much endeavor. Ideally, the fixer-upper you lot buy will only need cosmetic upgrades. Look for homes with:

- Peeling or dated paint (interior and exterior)

- Older bathroom fixtures and tile

- Dated kitchen cabinetry

- Laminate or tile countertops

- Stained rug

- Hardwood floors in demand of refinishing

- Leftover belongings or trash that need to exist removed

- Neglected landscaping

- Former or non-functioning appliances

How to buy a fixer-upper

Buying a home that needs work can be risky, because you won't know the full status of the home until y'all beginning tearing downwardly walls. That's why doing your due diligence on the property and neighborhood ahead of time is key.

Get a professional person dwelling inspection

When you put an offer on a business firm, be sure to include an inspection contingency. An inspection contingency allows you to back out of a bargain and become your hostage money eolith dorsum if the inspection reveals that the home has serious hidden defects.

Even homes marketed as being in "every bit-is condition" tin can exist inspected — the only difference is with an as-is home, the seller is telling you that they do non want to make any repairs based on your findings.

The heir-apparent is responsible for the cost of an inspection, which ranges between $250 and $700, depending on the size of the home and your location. In addition to a full general inspection, you might also opt for specialized inspections for trouble areas. Mutual specialty inspections include pests, sewer lines, radon, atomic number 82-based paint and structural inspections. Costs for specialty inspections are like to general inspections.

A structural inspection reviews the home's structural integrity, but also lets you lot know of any natural hazards nearby that could impact the resale value or your own health and safe. You may also consider hiring a structural engineer to appraise the property before you lot make an offering. It volition cost between $500-$700 but could save you thousands of dollars in futurity foundation repairs.

Hire an architect and full general contractor

An builder can create a new layout for a dwelling, create plans and blueprints and tell you lot what is and isn't possible. Some cities require you to submit architectural plans to acquire dwelling permits, making an builder a necessity. The average cost for an architect is around $5,000, depending on the scope of your project.

Your dwelling house inspector should exist able to give you a rough estimate of what information technology would cost to adequately repair problem areas that come up in an inspection, but since they're not the one who will be doing the work, information technology's best to get a more accurate quote from a contractor. Whatever they quote you, add a ten% contingency for whatsoever problems that come upwardly along the way. Be sure to go quotes from a few contractors and do your due diligence in checking their licensing and client reviews.

Upkeep for improvements

Working with your contractor, be sure that your upkeep takes into consideration all applicable costs. Don't forget to include:

- Permit fees , if applicable

- Cost of materials , like flooring, paint, light fixtures, cabinetry, countertops and hardware

- Price of labor , including full general contractors, plumbers, electricians and inspectors

- Cost of living during renovations , if the home will be uninhabitable during the project

Know your limits

Above and beyond the financial concerns, yous as well need to judge your tolerance for a major renovation project, especially if you plan to salvage money by doing some of the work yourself. Abode renovations are non as easy as they expect on Tv and if it's your first fourth dimension, a lot can go incorrect. Even if everything goes right, at that place's a lot of hassle involved in a large-scale construction project. Y'all'll have to live in a construction zone or movement elsewhere temporarily, while still paying all the carrying costs for the abode.

If the thought of a months-long renovation is more than y'all're willing to take on, but you're looking for a movement-in-ready home, consider a Zillow-endemic abode . Every home has been recently evaluated for buyers to avert costly surprises.

Financing options with fixer-upper loans

You can purchase a fixer-upper with a traditional conventional loan so pay for all the improvements out of pocket. Or, you tin get a fixer-upper mortgage that's designed to assistance you finance both the house itself and the renovations. Common types of domicile loans for fixer-uppers are:

FHA 203(grand) standard

An FHA 203(k) Standard loan finances the purchase and renovation of a primary residence. Here are the key requirements:

- Minimum credit score of 500 with a down payment of 10%, or a credit score of at least 580 with down payment of iii.v%

- The full toll of the loan must fall under FHA mortgage limits in your area

- No luxury improvements (like pools) are allowed, but structural work is allowed

- Requires a HUD consultant to approve the architectural plans, oversee payments to contractors and review inspections to ensure the home meets structural integrity and free energy efficiency standards

- There are limits on how presently you can resell (not within 90 days)

- The contractor is paid out of an escrow business relationship managed by the lender

FHA 203(k) streamlined

This financing choice has similar requirements as the FHA 203(g) Standard, but it's meant for simpler, corrective renovation projects, as information technology has a spending limit.

- Minimum credit score of 500 with a downward payment of ten%, or a credit score of at least 580 with downwardly payment of 3.5%

- For corrective upgrades nether $35,000

- There are limits on how soon you tin resell (not inside xc days)

- The contractor is paid out of an escrow account managed by the lender

HomeStyle loan

A HomeStyle loan is a combination home loan and home improvement loan, guaranteed by Fannie Mae.

- Minimum credit score of 620; minimum down payment of 3 or 5%, depending on a few factors similar owner occupancy, first-time home buyer condition and income

- Allows for other improvements that aren't covered under an FHA 203(yard), like pools and landscaping—simply note that all improvements need to exist "permanently affixed to real property (either dwelling or land)"

- The contractor is paid out of an escrow account managed by the lender

- You must apply a certified contractor

CHOICERenovation

A CHOICERenovation loan is a combination home loan and home improvement loan, guaranteed by Freddie Mac.

- Y'all tin finance renovations that cost up to 75% of a home'southward value

- Money can be used for upgrades that forbid natural disasters

- You can DIY the work and get a downwards payment credit

- Requires multiple appraisals to ensure yous're upholding the terms of the contract and that the agreed-upon renovations brand the habitation meet its estimated value

Source: https://www.zillow.com/resources/stay-informed/buying-a-fixer-upper/

0 Response to "How to Find the Best Fixxer Upper House"

Enregistrer un commentaire